- Yellow Dip

- Posts

- 🧀 Busted myths about Signature Bank & Is Bitcoin undervalued?

🧀 Busted myths about Signature Bank & Is Bitcoin undervalued?

PLUS memes and quick dips

GM, this the Yellow Dip - the weekly newsletter that is just good, smart, and quick

On our agenda, today we have:

Quick dips

Busted Myths about Signature Bank

Is Bitcoin undervalued?

Crypto portfolio is up🚀

Quick Dips

Busted Myths about Signature Bank Collapse

Following up on our previous week's story of bank collapses, we dive into some of the toughest questions and debunk the biggest myths in crypto.

What had happened? Signature Bank, a NY-based bank with over $100B in assets, was forced to shut down last Sunday by U.S. regulators. While it was reported that the bank was shut down due to money laundering issues and weak data reporting, it seems that there may be more to the story.

The Myth: Signature Bank was shut down because it was a "systemic risk” and was being investigated over money laundering issues, weak data reporting, and its ties to FTX.

The Truth: One theory is that regulators saw this as a perfect opportunity to send an anti-crypto message. Barney Frank, a Signature board member and self-described crypto skeptic, said that the shutdown was meant to scare banks away from crypto. It's important to note that the FDIC, the agency that seized Signature, never said that the bank was insolvent.

Another theory is that whoever buys Signature will be required to close its crypto business. This contradicts previous statements from regulators that Signature's closure had nothing to do with crypto. The FDIC has denied this report, but if the future buyer doesn't get Signet, the platform that Signature offered to easily transfer funds from crypto to fiat, we'll have our answer.

All three banks friendly to the crypto industry, including Signature, SVB, and Silvergate, have been targeted by regulators. This raises concerns about the U.S.'s approach to crypto innovation.

It's important to note that only 25% of Signature's assets were in crypto. So, was Signature shut down because it was a systemic risk, or was it part of a larger campaign against crypto? Only time will tell.

Is Bitcoin undervalued?

Bitcoin, the original cryptocurrency, is now the 11th most valuable asset by market cap. That’s right, it’s worth more than VISA and Facebook. And the best part? It’s still undervalued.

What's its worth? Now, I know what you’re thinking. How can a digital currency be worth more than companies that are building self-driving cars, smartphones, and e-commerce marketplaces? Well, the answer is simple. Bitcoin is the digital equivalent of gold. And just like gold, it’s a trusted store of value - light, portable & easy to transact.

Sure, gold has been around for centuries, and people trust it. But it’s heavy, hard to transport, and can’t be used to buy an adult happy meal from McD’s. Bitcoin, on the other hand, is portable, easy to transact, and can be used to buy pretty much anything.

Its true value? So, what is Bitcoin’s true value? Here’s a little formula we came up with:

(The number of people on earth who believe Bitcoin is valuable) x (the intensity of that belief)

The number of people who believe in Bitcoin has skyrocketed over the years. Hedge funds, countries, and companies all hold Bitcoin. And even your grandpa probably owns "1 Bitcorn." The intensity of that belief is growing too.

Why its undervalued? But can Bitcoin survive long enough to become a lasting store of value like gold? Only time will tell. But one thing we do know is that Bitcoin can survive anything. China bans it every year, the largest Bitcoin exchange was hacked, and the price of BTC has crashed 60%+ multiple times. And yet, it’s still alive and well.

Bitcoin is the honey badger of crypto. It doesn’t care about your regulations, your hacks, or your crashes. It just keeps going, defying all odds. So, is Bitcoin undervalued? Absolutely. And as more people recognize its true potential, its value will only continue to rise.

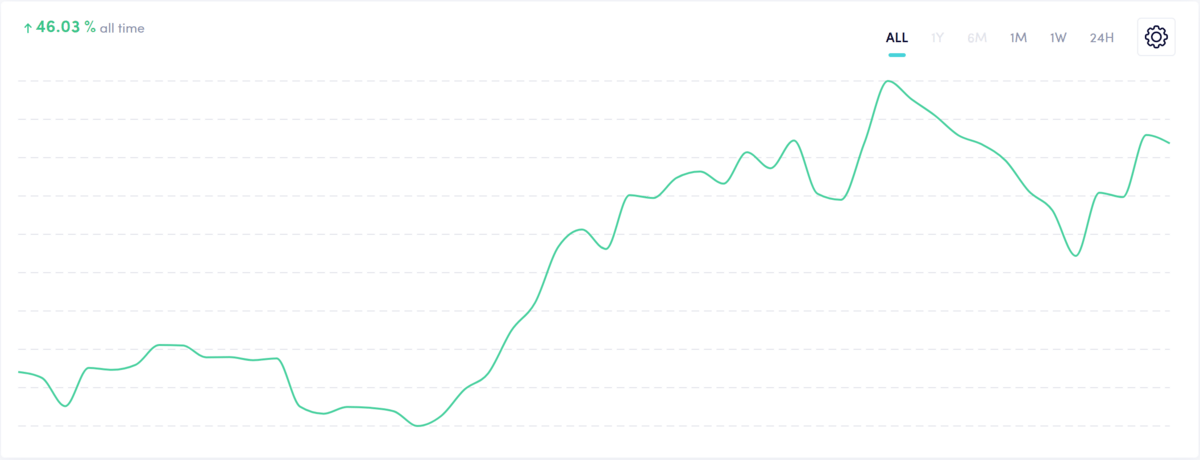

Yellow Dip Portfolio Performance is up!

This is how our starter's portfolio is performing, with our low-medium risk goal.

Our Portfolio (Last Week) : 3.27%

Our Portfolio (Lifetime) : 46.03%

😂

That's it for today. Stay curious & see ya next week! We hope you learned something new.

As always, feel free to share your thoughts and feedback, and don't forget to share our hard work!

What do you think of today's edition?

If you like the newsletter, ask your friends to subscribe with this link https://yellowdip.beehiiv.com/subscribe

DISCLAIMER: This newsletter is strictly educational and is not an investment advice to buy or sell any assets or to make any financial decisions. Please be careful and do your own research