- Yellow Dip

- Posts

- 🧀 Buying Bonds on Blockchain and Meme Coin gives 1000x in 3 days

🧀 Buying Bonds on Blockchain and Meme Coin gives 1000x in 3 days

PLUS memes and quick dips

GM, this the Yellow Dip - the weekly newsletter that keeps you organized and educated, so that you know all the tips and tricks.

On our agenda, today we have:

Quick dips

Buying Bonds on Blockchain

Meme Coin gives 1000x in 3 days

Crypto portfolio rallies down a bit🚀

Quick Dips

Buying Bonds on Blockchain

Here’s an idea to boost your portfolio - own Dollars.

Here’s an even smarter idea, earn interest on those dollars...

Millions of crypto users, hedge funds and smart institutions have loved the idea of being able to earn a yield on their assets but hate the idea of being restricted by jurisdictions and the massive paperwork involved in being able to register for such a service.

This use case gave rise to a whole new sector of financial services on the blockchain known as DeFi (decentralized finance).

DeFi & Bonds. Although DeFi is much broader than JUST being able to buy bonds, but the bonds market is actually the largest (approx. $133 Trillion) use case for the DeFi space. Institutional adoption of such services is a huge innovation in the financial sector.

P2P Lending. Maple Finance is a decentralized platform that allows investors to lend money to borrowers in a peer-to-peer fashion. The platform uses blockchain technology to create a transparent and secure lending environment, where lenders can earn interest on their investments, and borrowers can obtain funding without going through traditional financial institutions.

One of the advantages of using blockchain technology is that it enables global access to financial services, regardless of geographical location or citizenship. This means that non-US residents can participate in lending and borrowing activities on Maple Finance, as long as they have access to the internet and a cryptocurrency wallet.

The platform has already initiated loans worth almost $2Billion, distributed $46 Mn in yield (interest) and has recently launched a yield bearing solution for non-US investors like you and me. This can enable a retail user to hold part of their cash funds in USD and earn interest on them via investments in US treasury bonds, which makes the underlying guarantee on the platform much safer than previous ideas.

By enabling non-US residents to buy bonds on the blockchain through Maple Finance, the platform can potentially provide access to new investment opportunities and increase liquidity in the market.

Meme Coin Pepe goes Viral with Early Speculators Earning 1000x in 3 days

What's a meme coin? Meme coins is a sector of coins in crypto which is the epitome of speculation. The success of a meme coin is solely based on hype and social media. Hundreds of meme coins are created everyday with the hope that speculators, influencers and insiders will make the coin go viral across social media and attract more speculators. This results in a coin going from a low market cap of barely thousands of dollars to millions or billions in market cap in a few days, weeks and months.

Doge coin was the first Meme coin and last cycle we saw the rise of Shiba Inu, both of which sit at Billions of dollar in valuations now. In my opinion these are the only two coins which have gone on to support the community as they got large enough.

Pepe is the latest. And every once in a while we get coins which catch the fancy of speculators. Last week on the 14th, an anonymous dev launched a coin called Pepe, based on Pepe the frog at a valuation of $10,000. In the following week, the coin now has more than 20,000 holders and sits at a market cap of more than $100 Million. With meme coins, 9 times out of 10, Its a game of musical chair where the early investor sells on the late investors, essentially taking their dollars and the early investors here are no different. An early investors in pepe investing just 25$ in the coin exited with $800,000.

Some advise. Meme coins remain risky and attract retail investors by selling a dream of financial freedom and I choose to stay away simply because it's not a part of my risk profile. But if you are looking to gamble, don't put a large amount of money in these coins and always manage your risk.

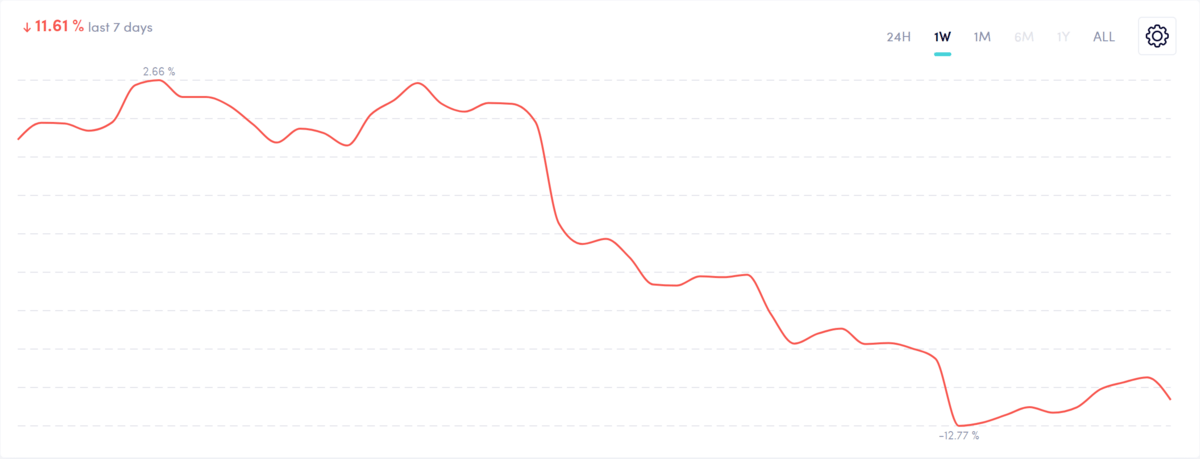

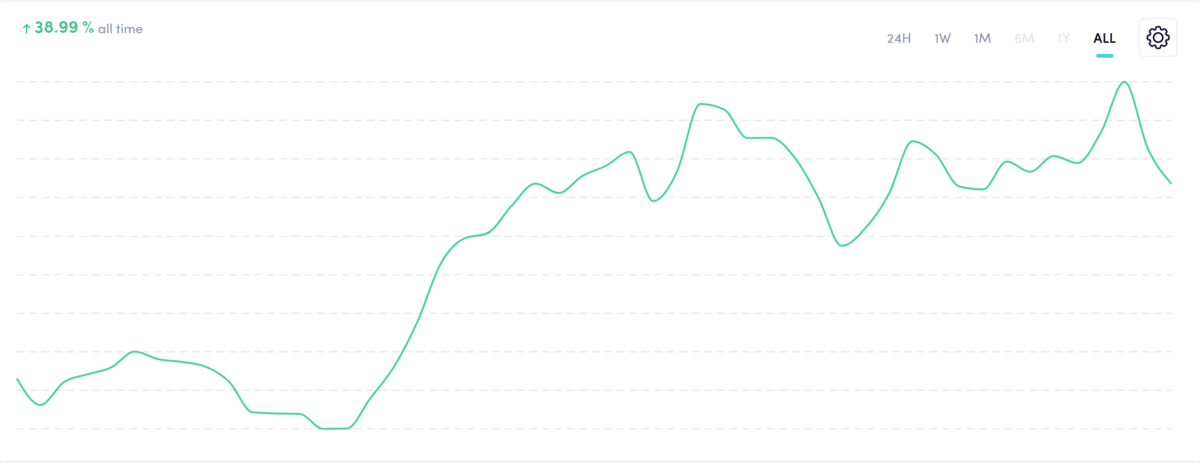

Yellow Dip Portfolio

This is how our starter's portfolio is performing, with our low-medium risk goal.

Our Portfolio (Last Week) : 11.61%

Our Portfolio (Lifetime) : 38.99%

😂

That's it for today. Stay curious & see ya next week! We hope you learned something new.

As always, feel free to share your thoughts and feedback, and don't forget to share our hard work!

What do you think of today's edition?

If you like the newsletter, ask your friends to subscribe with this link https://yellowdip.beehiiv.com/subscribe

DISCLAIMER: This newsletter is strictly educational and is not an investment advice to buy or sell any assets or to make any financial decisions. Please be careful and do your own research