- Yellow Dip

- Posts

- The FTX collapse explained & are cryptocurrencies speculative?

The FTX collapse explained & are cryptocurrencies speculative?

PLUS meme and quick dips

Good morning! This the Yellow Dip - a weekly newsletter throwing you assist after assist to help you score in blockchain.

Today, we'll cover:

What is the FTX collapse? What it means?

Is crypto speculative?

Quick dips

What is the FTX collapse? What it means?

Over the past couple of months, FTX has been in the mainstream media. Simply, FTX is a crypto exchange - for context, the third largest by volume after Binance & Coinbase. And Sam Bankman Fried (commonly referred to as SBF), is its CEO & founder.

The allegation. FTX was not holding its customer funds with them.

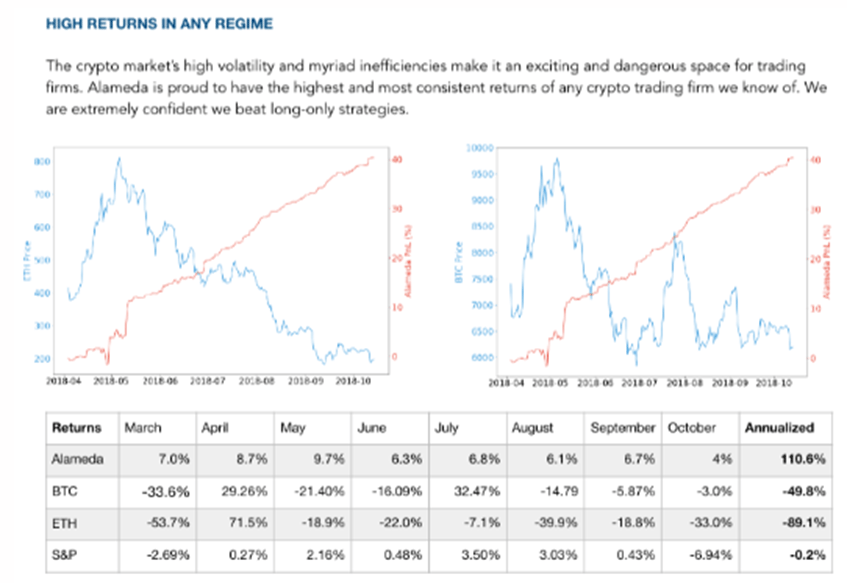

But why did people trust on SBF at the first place? Basically Sam (or SBF) has super credentials - MIT grad, parents are Law Attorney & Stanford professor, he himself developed trading algos for a large firm Jane Street Capital & launched his own crypto trading firm Almeda Research, which raise around $1Bn by the end of 2020.From their 2018 deck,

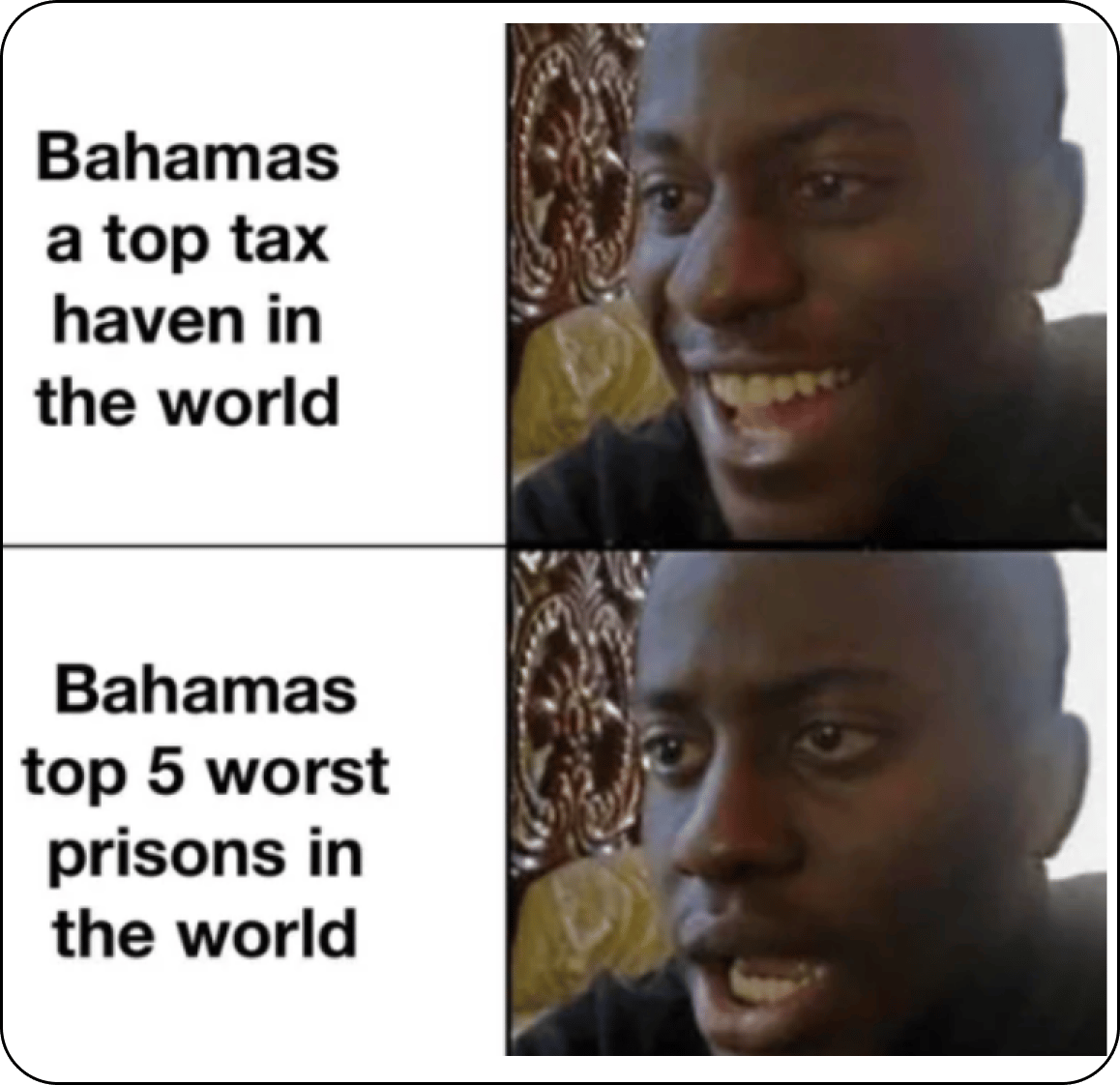

So, how did FTX rise? SBF wanted to go big, he launched FTX crypto exchange with a tagline “built for traders by traders”, incorporated in Antigua and Barbuda and headquartered in the Bahamas. Every Silicon Valley VC, who missed the Coinbase bus, wanted to have a piece (some notable investors - Binance founder, Shark Tank’s Kevin O Leary, Singer Madonna, Tennis Player Naomi Osaka and many other). So in total, FTX raised over $1.8 Bn from 2018 through to Jan 2022 at a peak valuation of $32 Bn.

So, what went wrong? We can start this with the Luna crash in May'22(Luna is a token). This wiped out around $20Bn and led to crash in crypto prices. So, the companies which were into borrowing & lending, were forced into insolvency, almost overnight. A lot of these were large traders on FTX. This would have hit FTX (and SBF) badly, and it was recently discovered that FTX started to diverge customer funds (of course without permission) to support Alameda Research, who indulged in high-risk strategies to deliver promised returns. So clearly, something fishy.

Then, FTX launched its own token FTT, due to which Binance (a competitor) wanted to exit the FTX investment in Oct'22. This resulted in large sale volumes, and SBF had to look for additional funds to support trade, failing which, had to halt withdrawals for their retail and institutional users.

Some other notable gaps:

Caroline Ellison (Sam's gf with 19 month trading experience) appointed CEO

Multiple interparty loans were issued within its own 130 incorporated entities

Unprecedented growth in personal wealth of CEO SBF (property worth Billions in Bahamas) & the team.

Out of $8 Billion due, FTX as of today has only $740 Million in its coffers.

And, is someone looking into this? What's the impact Yeah, kind of. And the impact here is not only on the customer & investors of FTX, but on the crypto ecosystem as a whole. SBF was charged by US department of justice on 8 counts including Fraud. And was arrested from the Bahamas, pending extradition to the US.

This has exposed other crypto lenders/miners at the risk of going out of business, if they are unable to find a suitable funding options/exit (no one is going to buy them). This is also a step back in the overall progress made on regularization of the cryptocurrency space, it’s products and exchanges. Regulators now have a chance of painting the whole space as the villain instead of just incriminating SBF. And, markets are still trading weak and large players are waiting for things to improve before putting in any serious $. What's you take on what could happen next? Tweet to us on this story #YellowDiponFTX

Well, this was a long one. So, let's keep it short for the second one today. Let's talk on some beliefs & myths.

Is crypto speculative?

Yes. Just like any other investment in any other asset class, crypto currency prices are speculative. Means price rises and falls on a daily basis.

But why do they rise and fall more than your normal investments like mutual funds or stocks like Apple, Google, Reliance, and popular commodities like gold even?

Because less number of people participate in the ecosystem currently. Total market size of the space is just around $500 Billion. That is less than 1/3rd the size of giant companies like Apple etc. Also people involved in the space are more emotional about price rather than fundamental developments. This changes over time as the space matures.

Our take – Although the price trends show massive increase and drops on rolling 6 months basis, but long term adoption is moving comfortable up only over time. Crypto now has 400 Mn users (not traders) instead of 30 Mn, 5 years ago and is still smaller than the Internet by a factor of 10. So prices will be volatile near term but will rise over time in line with the adoption curve of technology

And SBF found out real quick ;)

Quick Dips

+ Trump released a new NFT collection called Trump Cards (Collect Trump Cards)

+ Japan Reduces 30% Crypto Tax On Paper Earnings For Token Issuers (Blockchain News)

+ Inside the Jordan refugee camp that runs on blockchain (MIT Technology Review)

+ Blockchain & governments: A look at how Colombia is using blockchain technology to store and maintain records of its land deeds (CNBC TV18)

Take a dip to start understanding Blockchain, go through this free learning resource.

That's a wrap for today. Stay hungry & see ya next week!

What do you think of today's edition?

If you like the newsletter, ask your friends to subscribe with this link

DISCLAIMER: This newsletter is strictly educational and is not an investment advice to buy or sell any assets or to make any financial decisions. Please be careful and do your own research