- Yellow Dip

- Posts

- Understanding India's CBDC Experiment & How Zoho Uses Blockchain

Understanding India's CBDC Experiment & How Zoho Uses Blockchain

Good morning! This the Yellow Dip - an awesome newsletter that makes you read more Blockchain every. single. time. and crave for more.

Here's what we got today:

How Zoho uses Blockchain for eSigning - this is real world!

What's the fuss about India's digital rupee or e₹

Quick dips

How Zoho uses Blockchain for eSigning - this is real world!

We all have heard about the cool stuff that Blockchain can do in future and this technology is "yet to arrive". But I came across this - and this is already being used by Zoho, a real world use case where, for each document signed on Zoho Sign, there is a public Ethereum transaction in the background. Now this is worth understanding.

What is eSigning? eSign, or esignature technology, is a digital alternative to the traditional paper signing method. With the help of an eSign app, like Adobe, Zoho Sign or others, you can digitize all your paperwork and use a cloud-based process to esign PDF documents online and make your operations paperless. eSignatures are legal, trusted, and enforceable around the world in most countries.

Challenges with current eSigning and how does Blockchain add value? Currently, PDF has some basic security features like password protection, digital signatures and encryption (conceal data). Digital signatures were added to PDF to verify who created and encrypted it. But it is not so challenging to sabotage this security, meaning that some sophisticated engineer can still change the content and the date/time of the digital signature. Additionally , if multiple parties need to sign there are constraints around how to maintain the chronology of signing & who modified what.

Enters Blockchain. It has the ability to maintain different versions of the document and can save an accurate time stamp/date and the identity of the person who signed the document. So, it can become possible for multiple parties to sign a document through a legally and secure binding process.

For the original document uploaded in the software (like Zoho Sign), a hash is calculated and the value gets stored in the blockchain. Authorized parties can verify that the copy of the document is legitimate by matching their version’s hash with that of the original version’s hash stored in the blockchain. In the case of multiple copies with different signatures, parties can use the blockchain document signing platform to look at the timestamps associated with the document’s metadata

What's the fuss about India's digital rupee or e₹

India's e₹ is a CBDC (Central Bank Digital Currency). It is a digital form of currency for transactions, like cash.

How is it different from India's UPI or Paytm like wallet? So, UPI feels like a person to person/merchant payment, but here's what goes in the background. When you hit "send" or "pay", you actually make a request to your bank (who holds your money) to send that money. Your bank then transfers the money to the beneficiary/receiver account through the receiver's bank. In the background, these two banks go through an elaborate settlement process (not real time), to make sure everyone get's the share of profit in the transaction.

With the digital currency, you are the custodian of your own money (and not the bank). Therefore, the money is transferred from you to another person - which means no middlemen (like a bank). It is like giving cash from one person to another, which does not involve a bank in between. So you see, this has certain benefits -

less middlemen means the transaction gets cheaper

no daily limits (because this imposed by bank)

country saves tonnes of money on printing money

counterfeit currency is less of a problem (until someone figures a hack!)

traceability becomes easier (which you & me won't like - privacy concerns)

Now since it is cash, it should not earn any interest. And because this is digital, the government can program it, to work the way they want, which keeps India's central bank RBI interested. So, this will have some impact on the way the economy works. We keep you posted on this.

The RBI has decided to first conduct a pilot rollout (with 8 banks) of the retail digital rupee. The first phase started 29th Nov'22, has four banks across four cities - Mumbai, New Delhi, Bengaluru and Bhubaneswar.

RBI's CBDC Concept Note & an interesting article to read further

And I found a meme - that kinda struck a chord! ;)

Quick Dips

+ The European Central Bank thinks bitcoin is on its last gasp. It says the cryptocurrency is on “the road to irrelevance.” (The Guardian)

+ Top early stage venture funds in crypto (Twitter)

+ Times aren’t great for NFT artists right now. (New Yorker)

+ It’s okay to opt out of the crypto revolution. (MIT Technology Review)

And by the way, if you are still figuring out where to start with Blockchain - here is a link you should read to feed your curiosity.

That's a wrap for today. Stay hungry & see ya tomorrow!

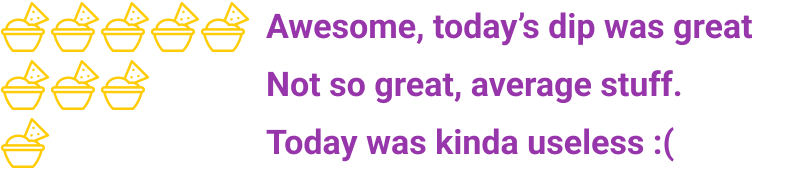

What do you think of today's edition?

If you like the newsletter, ask your friends to subscribe with this link

DISCLAIMER: This newsletter is strictly educational and is not an investment advice to buy or sell any assets or to make any financial decisions. Please be careful and do your own research